Industry Leap Amid Tariff Breakthrough: The Rebirth of E-Cigarette Overseas Factories

From Trade War Freeze to Strategic Opportunities in Supply Chain Reconstruction

Introduction

In the early hours of April 9, 2025, the United States officially implemented "reciprocal tariffs" on Chinese imports, with the cumulative tariff rate on e-cigarette products reaching 104%. This sudden policy shift, while increasing export pressure in the short term, has also opened a strategic window for Chinese e-cigarette companies with overseas factories to "fully activate" their operations.

Trade War Freeze: The End of the Light Asset Model

Looking back to 2018, the U.S.-China trade friction escalated, with e-cigarettes and other products added to the high-tariff list, disrupting traditional distribution channels from Shenzhen to North America. During this time, many companies quietly began setting up operations in Southeast Asia, Europe, and the U.S., laying the groundwork for a future "breakthrough moment."

Tariffs Driving Change: Overseas Factories Activate Against the Trend

With global industrial policy adjustments, Chinese companies have started operations in factories in Malaysia, Indonesia, and other regions. For example, the current tariff on exports to the U.S. from Malaysia is only 24%, while Indonesia's is as low as 17%. When considering logistics, labor, and policy costs, manufacturing overseas can save over 40% compared to direct supply from Shenzhen.

Four Key Nodes: A New Global Industrial Landscape

Indonesia: Southeast Asia's Gateway

Companies have established oil and HNB (Heat-not-Burn) cartridge factories in Batam Island, aiming to dominate the European and U.S. alternative smoking markets.

Malaysia: The Compliance Manufacturing Hub

With a mature local registration and manufacturing system, Malaysia is becoming an essential manufacturing base for Chinese brands.

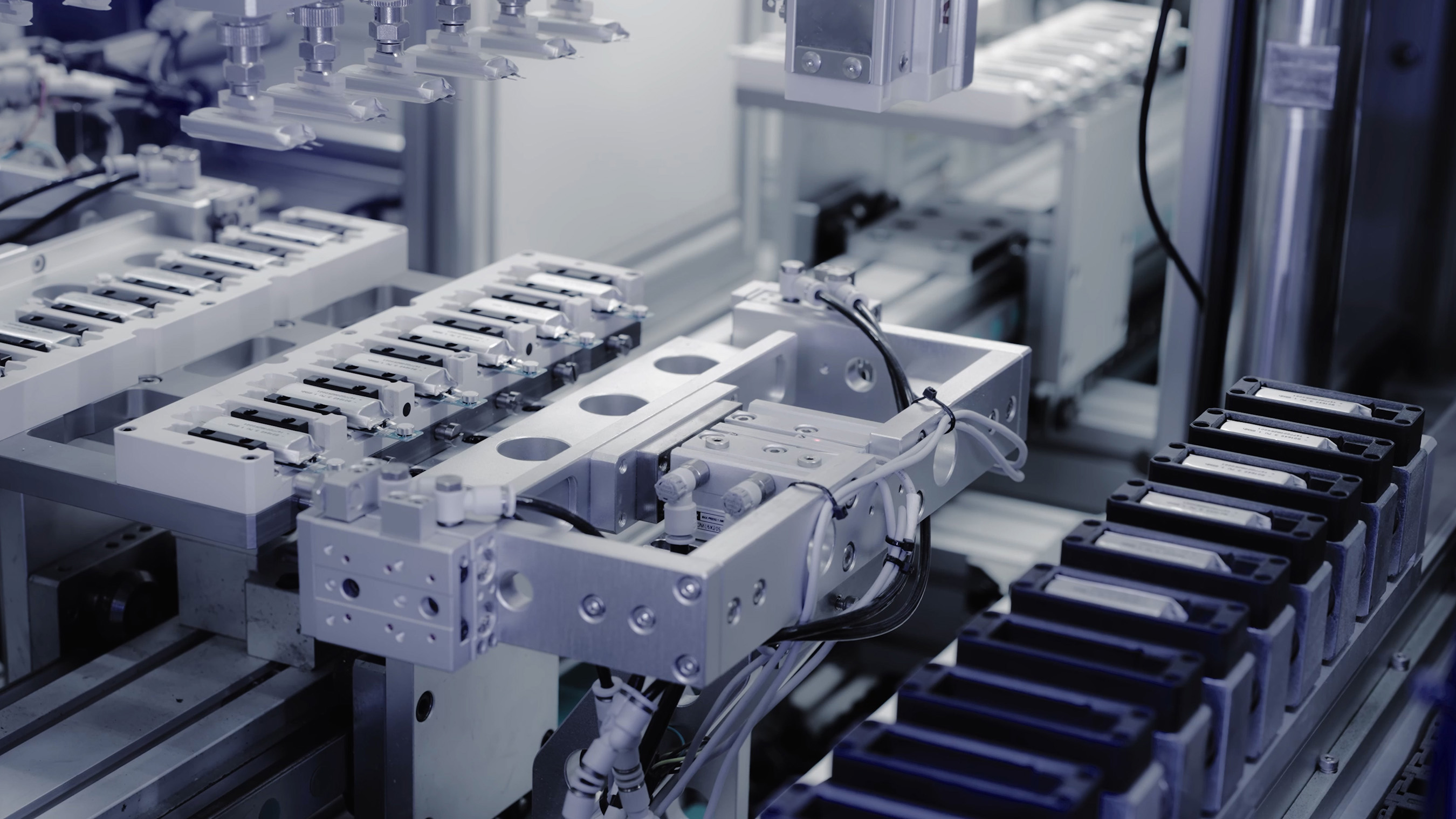

United States: Domestic High-End Production Lines

To meet FDA's stringent requirements, Chinese companies have built cleanroom facilities in the U.S. to achieve full-process compliant production.

Europe: Local E-liquid Factories in Response to TPD

In response to EU regulations, companies like Hengxin and Dekang have set up small, flexible production lines in Europe for local production and sales.

Three Strategic Upgrades: From Manufacturing to Creation

Cost Structure Reconstruction

Overseas factory layouts and a "dumbbell-shaped" supply chain combination have improved production efficiency and reduced overall operational costs by 35%.

Integrated Compliance Systems

From Malaysia to Germany, more overseas factories have integrated testing and certification capabilities, helping to proactively avoid policy risks.

Technology Empowerment and Transformation

Companies no longer just export equipment; instead, they offer "technology + data + system" integrated solutions for local brands, establishing a new industrial voice.

Strategic Echo: The Industrial Expedition from Shenzhen

Today, when overseas customers open products labeled "Designed in Shenzhen," they see how Chinese standards and Shenzhen's intelligence are deeply permeating the global e-cigarette value chain. This is not just a competition of factory locations, but a dual leap in supply chain efficiency and technological output capacity.

Disclaimer: This article is original content. Some information is referenced from public policy updates and industry data, aiming for an objective analysis. It does not constitute investment or legal advice. Please cite the source and obtain authorization if you wish to repost.