Comprehensive Trend Analysis Report (2022–2025)**

IPURE Market & Compliance Team

China has become the primary global supplier of e-cigarette products. According to customs statistics and third-party industry data, China’s e-cigarette exports have long remained at a USD 10-billion-plus scale, accounting for a substantial share of the global market.

China’s export statistics mainly cover “electronic cigarettes and similar personal electronic vaporizing devices” as well as “other non-combustible nicotine-containing inhalation products.”

Data Notes:

Detailed official figures prior to 2022 are not fully available; however, industry reports and customs trends indicate a period of rapid growth.

From 2022 to 2025, exports have shown high-level fluctuations accompanied by gradual structural optimization.

Total exports in 2025 reached approximately USD 10.598 bn, representing a YoY decrease of about 3.31%.

Exports covered 202 destination countries, highlighting China’s extensive global market reach.

Customs data reference:

https://docs.google.com/spreadsheets/d/1tBcnG3Pz4He0-ghmkVqq4_xS8c297Pit_p5WOyq5IKo/edit

Trend Insight:

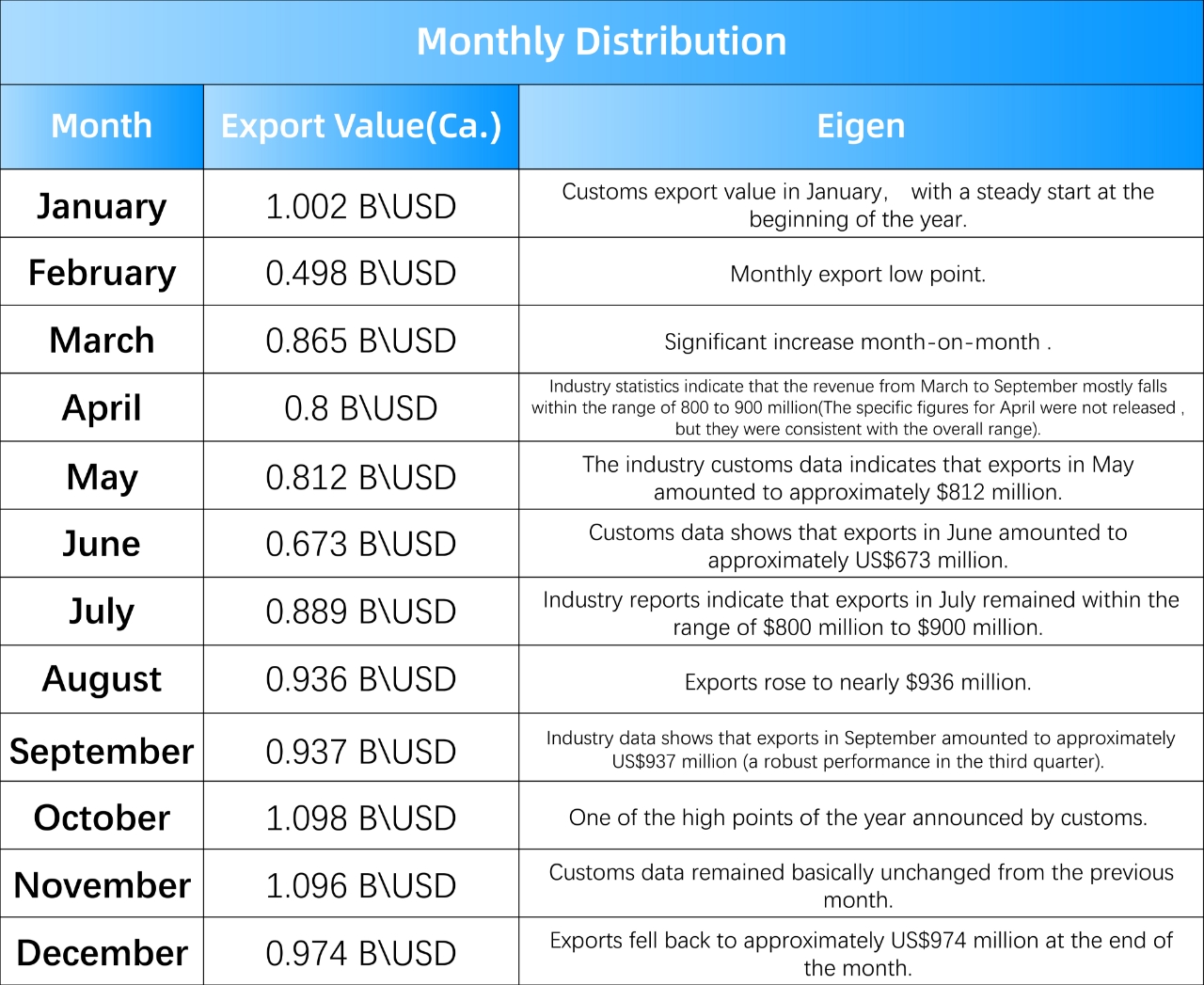

Exports followed a distinct pattern of “early-year decline → spring recovery → summer growth → autumn/winter peak,” closely tied to global demand cycles, regulatory milestones, and logistics rhythms.

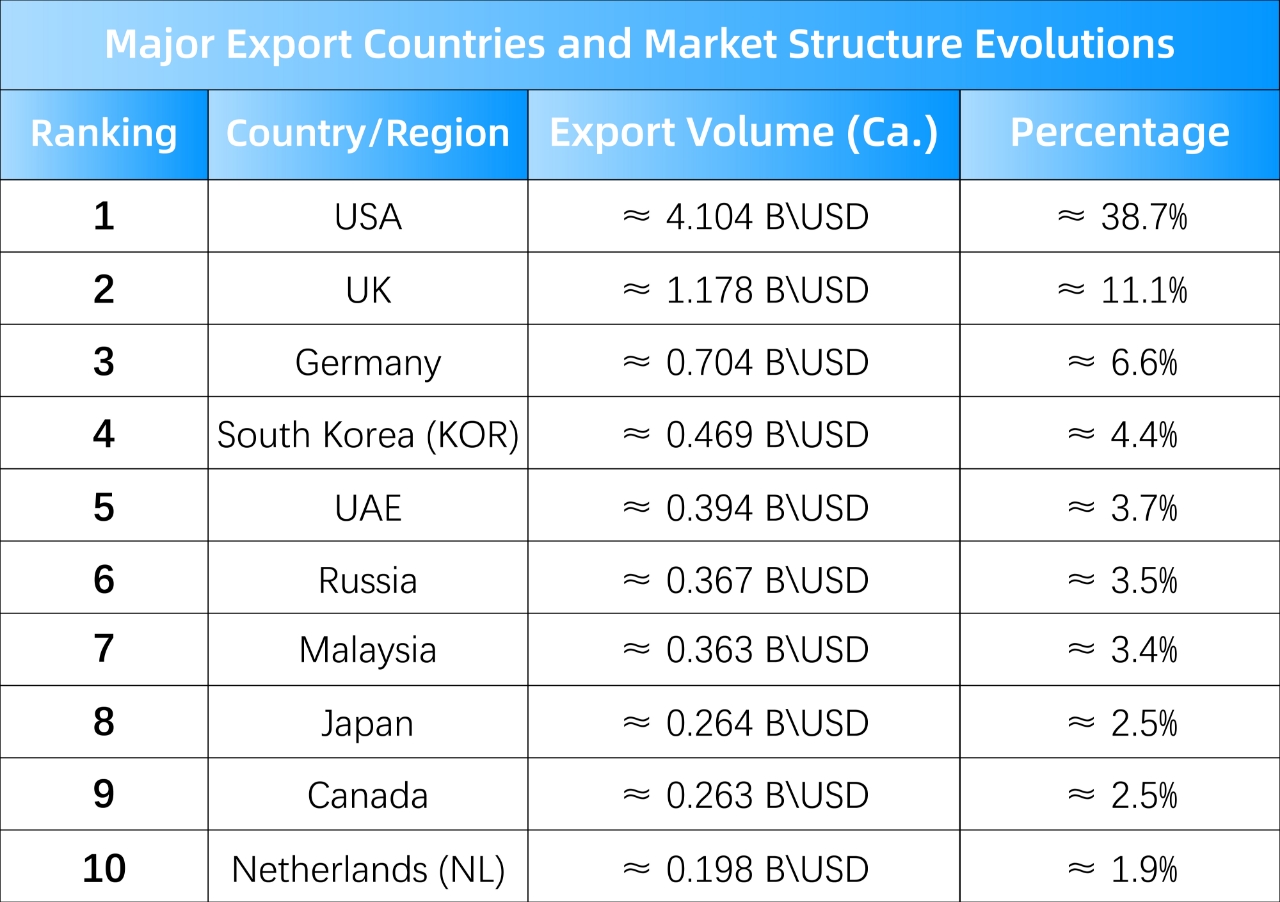

These figures reflect an increasingly diversified export market structure. While Europe and North America remain core markets, Asia and the Middle East are steadily increasing their contribution.

Based on the 2025 customs data structure:

Other non-combustible nicotine products (e.g., disposable e-cigarettes, e-liquids) accounted for the majority, totaling approximately USD 7.33 bn.

Electronic vaporizing devices and related products (including devices and accessories) accounted for approximately USD 3.27 bn.

This indicates a shift from reliance on single hardware categories toward a broader, more diversified product mix, with nicotine-containing consumables and disposable products maintaining strong market demand.

Major markets—particularly the U.S., U.K., and EU—have tightened regulations. For example, the U.K.’s ban on disposable e-cigarettes effective June 2025 has exerted pressure on related export categories.

Product preferences vary by region. Mature Western markets show stable demand for rechargeable and branded devices, while parts of Southeast Asia continue to see rapid growth in portable and disposable products.

Higher tariffs and customs clearance costs for Chinese exports in certain countries have affected order cycles and shipment timing.

As a participant in China’s e-cigarette industry, iPure operates within the following industry landscape:

Highly export-oriented industry: Long-term export values remain at multi-billion-dollar levels, reflecting global reliance on Chinese manufacturing.

Diverse product segmentation: Export data covers both devices and nicotine-containing products, indicating broad business coverage and adaptability to different market demands.

Pronounced seasonal cycles: Clear monthly fluctuations require exporters to align operational strategies with spring demand recovery and autumn-winter peaks.

Strong YoY growth driven by global market adoption and China’s manufacturing advantages.

Limited regulatory constraints during the early stage of industry internationalization.

Regulatory tightening across multiple markets led to structural pullbacks, though the overall industry base remained large.

Product formats diversified as the industry adapted.

Despite mild declines, exports consistently maintained a USD-10-billion scale, with expanding global market coverage and a more mature international footprint.

Market Diversification: Further expand into Asia, the Middle East, and Latin America to mitigate regulatory risks in Europe and North America.

Product Upgrading & Compliance: Enhance technology and compliance systems to meet evolving regulatory standards.

Supply Chain & Branding: Strengthen overseas warehousing, localized services, and brand development to improve resilience and long-term competitiveness.